Yesterday I

was asked by a good friend and loyal reader to provide a refresher on how I set

about my analysis of the market. So here is the first in what I plan to be a

series of essays which cover the basic elements that make up my thinking about the market. For those of

you who know it all and are only interested in the bottom line, just skip to the

end of this post for my latest thoughts.

First let

me remind you that I do not claim to be a fount of wisdom. I do what I

can and in this blog I describe what I see and how I interpret it.

Playing the

stock market is a fascinating occupation and in some ways is unlike any other.

In most disciplines you learn your skills and strive for perfection. In playing the markets the important qualification is realising when you have got it wrong and knowing what

to do next. Mistakes are inevitable. That is not to say you don’t try to get it

right for as much of the time as possible.

There are

just two things I am reasonably good at:

- One is

picking shares when the time is right

- The other

is not being there when the market turns sour.

In this

first refresher I am going to describe how I try to pick my moments for

entering and exiting the market. And when I say exiting I mean

selling up and going into cash. No half measures. A falling market pulls down

all shares including good ones.

So here we

go. All basic stuff. No rocket science. The market is made up of buyers and sellers and by watching the way the price

moves I try to guess where the market is headed next. I see price action

by looking at the graphs of market price movement. Because I want to know how

the whole market is moving, I look at the “Index” which measures what the market is doing.

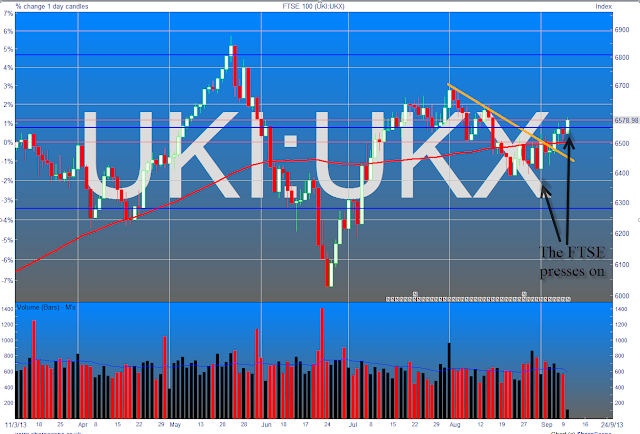

Mostly I

look at the daily chart, so that is where I shall focus my attention. I favour candlestick charts

because provide lots of information about what has happened during each

day's trading. A little imagination allows you to interpret what has been

going through the minds of the market participants. Knowing this helps me guess what is likely to happen tomorrow.

What each candle shows

Each candle

on the chart represents one day’s price action. First the colour:

- If the

candle is red the day’s closing price is lower than the previous day’s closing

price

- If it is

green the price closed higher than the day before

- If the

colour is solid the price closed lower than the level it opened in the morning

- If there is

a white middle to the candle it closed higher than it opened in the morning

The body of

the candle (the fat bit) represents the movement between the opening and

closing prices for the day.

The two

thin “wicks” above and below the body show the highest and lowest prices that

the price achieved during the day.

Those wicks

give some information that can be used to infer what was going through

traders’ minds during the day. A long wick below the body suggests that sellers

succeeded in pushing the price down by dumping the stock, but buyers sensed the

opportunity to get a bargain and pushed the price all the way back up again.

A bunch of

committed buyers in the market makes me think that, other things being equal,

there will be a follow through and the market will go up tomorrow. And vise

versa.

A column of marching candles

Looking at

a column of marching candles tells me where the market is heading. There are

only three ways to go: up, down or flat.

The market

has a sort of collective mind. With the right sort of skills one can guess what

that mind is thinking. Imagine you are reading the expression on your friend’s

face to judge if she is happy or sad, angry or calm. Reading the market by

looking at the charts is a bit like that.

At any time

there will be players in the market who think that shares are cheap and will

want to buy more, and those who think shares are too expensive and will want to

sell the shares they hold.

The mass of

shareholders will be doing nothing, but they don’t count. They will just sit

there and pat themselves on the back when the market is going up and say to

themselves “how clever I am.” When the market falls they will wet their

pants and still do nothing until it's too late.

Collective memory, support and resistance and trends

Traders who are active in the market behave as if they have memories of what

has happened before and this recollection is reflected in a shift in the balance of buyers to sellers. It’s a bit like a conditioned reflex. When the price

reaches a certain point the balance switches and a market

that has been going up will change to go back down and vise versa.

These boundaries

are support and resistance lines. They can hold for days, months or years. When

price action respects these lines the market is said to be trending. Buying

shares in a market that is trending upward is the road to riches. Spotting the

end of one of those trends, the break of support, and cashing in profit is the key to fortune.

The market

also remembers old highs and lows and when it reaches those points it also encounters

resistance or support. These are drawn as horizontal lines on the chart.

At the bottom of the chart

a vertical line how many shares were traded each day. Occasionally the volume of

shares bought and sold spikes. This means that the market has been more active than usual. I pay special attention

to these spikes because it suggests to me that a shadow has passed across the

face of my friend and I can expect a change in her mood.

\That's enough for now. There'll be more another day. I hope this helps to clarify the comments I make each time I post.

Back to Friday's action

Friday's action was not decisive. Monday is Labor Day. It's a holiday in the US and traditionally it signals the end of the summer vacation period and the beginning of the Autumn (Fall) and winter term in the stock market year. What happens next is anybody's guess and Friday's action gave no clues.